Last Updated on November 19, 2022 by Hamna Nouman

Distinct kinds of credit are called credit mix. It might involve home loans, credit cards, personal loans, car loans, etc. Balancing out the risk vs rewards can assist you in holding a strong credit score. The first thing first is having a strong credit mix of distinct kinds of credit accounts adds up to the fundamental hygiene factor of your report. However, it is not considered the most crucial aspect of shaping your score. Financial institutions and lenders do review your credit report when you place an application for or credit card. Evaluating your credit report assists you in understanding your credibility. The better your score is, the higher your chances of getting your credit application approved.

You conductCIBIL check online through the official website of CIBIL or by visiting online lending marketplaces for monthly updates. Ensure to keep your PAN card handy when conducting CIBIL checks online. This is because you can check CIBIL score by PAN card number only. Without a PAN card, it may not be possible for you to conduct a CIBIL check online.

Let’s check out what’s distinct kinds of credit accounts and how they affect your credit score –

What are the distinct kinds of credit accounts?

Before you begin analyzing your credit report depending on the credit mix you have, you should understand what they are, how they work, and how their arrangement impacts your credit score. Majorly there are 3 distinct kinds of credit accounts. They are –

Revolving credit –

By definition, it must be clear to you that revolving credit is a line of credit wherein you, as a borrower, may be assigned a specific set credit card limit for the use of it to spend on your daily requirements and expenditures. Repayment of the same must be made over a time period. A revolving credit may be a secured credit option or an unsecured credit option. In a secured kind of revolving credit, you as a borrower must offer a lien or mortgage, i.e., the security to avail of the loan. While in the case of an unsecured revolving loan form, no security is required to be pledged to secure a loan. For instance, a home equity credit line is a secured kind of revolving credit option, while a credit card is an unsecured kind of revolving credit option.

With this kind of credit account, i.e., revolving, the credit card limit is fixed, and it does not increase. You, as a borrower, might require paying the debt along with interest fees, if any, in the form of monthly repayments.

Instalment credit –

This kind of credit account is mostly used to purchase a big-ticket good or product. Instalment credit is usually used for the payment of a specific item. The price of the item is later split into instalments, which you must repay. Let’s understand this with the assistance of an instance. Suppose you have included a few goods in your cart on the shopping site. The whole cart amount here will be spread over a predetermined period that you must repay timely and in full.

Open credit

Open credit is a kind of credit account that is preferred least by consumers. And why is this so? It is because it holds a fixed credit limit, i.e., how much you, as a borrower, may spend. However, you must repay the entire borrowed amount in one shot.

How do the distinct kinds of credit accounts affect your credit score?

Credit diversity is one of the common parameters that is factored in a while computing your score. If you have distinct kinds of credit accounts like personal loans, credit cards, home loans and car loans, lenders may think you can manage distinct kinds of debt options.

Maintaining different credit accounts may assist you in ameliorating your credit score. However, this does not mean you must open distinct credit accounts you do not need. This is because having a different mix of credit will not reduce your score drastically.

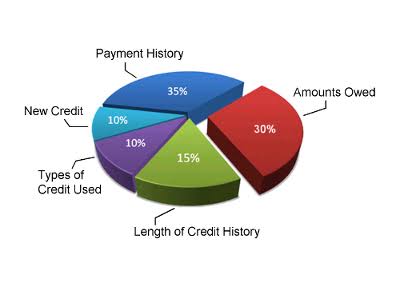

Based on credit score methodology, credit mix might be one of the lesser parameters considered by the credit bureau when computing your credit score. Your payment history on accounts, credit history duration, your credit utilization ratio and the loan or credit limit amount that you owe are incorporated to calculate your credit score.

However, in case you have a mix of distinct kinds of credits, make sure that you timely repay your credit in full. If you fail to manage your credit and default on your repayments, it may negatively affect your score. Use the credit as per your repayment capacity. Avoid going overboard only to keep up with a high-end lifestyle. It might backfire in case you do not prepare a proper financial plan to attain the goal that you have set for yourself. If you decide on adding distinct kinds of credit accounts into your portfolio, form a budget and aggressively work around the same. Assess your present financial standing and decide accordingly.

Ending note

You must ensure to figure out the reason for your struggling credit score if you want to ameliorate it. Note that your score cannot enhance overnight. You must put in some effort and hard work by developing sound and healthy financial habits. A score is a statistical numerical representation that evaluates your credibility. Based on your credit history, your credit score is computed. Often, lenders concentrate on the score to assess your chances of repaying the borrowed loan or credit limit. Your credit score may range anywhere between 300 and 900, wherein a score near 900 is considered to be good and on the higher end, which signifies you are financially strong to avail of a loan and repay it on time and in full. Based on your credit score, you may be approved for all kinds of credit options, which may be revolving, secured or unsecured, instalment credit or open credit option. So, note that the key to availing a loan as per your requirement and preference is only one, i.e., having a good credit score of 750 and above.